Sharing our expertise.

We are grateful that 94% of our clients are referred to us by accountants, lawyers, and financial advisors. The following articles and presentations are our way of sharing our expertise with those who’ve helped make us a success.

INSIGHTS AND ARTICLES

Dean Guest Speaker at Advocacy Club Event

On January 25th, Dean was a guest speaker to Ottawa’s Advocacy Club, which provides training to junior lawyers. Dean’s presentation was titled “Attracting your Ideal Clients by Sharing your Expertise”. Dean is passionate about this topic because when lawyers share their expertise, through webinars, articles, and other channels, it helps clients find the lawyers that specialize in the issues they are facing and can even help clients avoid the legal issue in the first place.

The Blachford Brief – Winter 2022

Welcome to the Winter edition of The Blachford Brief. Each quarter we share content to help your clients avoid tax disputes and catch you up on news from our professional community.

Tax Dispute Update 2022 Video and Slides

On Nov. 1st, 387 professionals attended our 6th annual Tax Dispute Update to learn how to help their clients avoid a bad ITC audit. Here are the webinar recording, presentation slides, and bloopers from Tax Dispute Update 2022.

CRA’s Power over Accounting Firms on Display in Zeifmans LLP v. Canada (National Revenue)

The CRA’s broad powers to compel accounting firms to turn over information and documentation pertaining to their clients were recently on display in the case of Zeifmans LLP v. Canada (National Revenue). In this article, we summarize Zeifmans and recommend four actions your firm can take to mitigate the potential damage of a Requirement for Information.

Community News - Ottawa Accounting Firms Celebrate the Season of Giving

Nothing gets us in the holiday spirit more than hearing about the charity work and donations that Ottawa’s accounting firms undertake for the holidays. So, this year, we’ve profiled four Ottawa accounting firms who go all out to celebrate the season of giving.

The Blachford Brief – Fall 2022

Welcome to the Fall edition of The Blachford Brief. Each quarter we provide content to help your clients avoid tax disputes and catch you up on news from our professional community.

Dean Publishes Article on Section 160

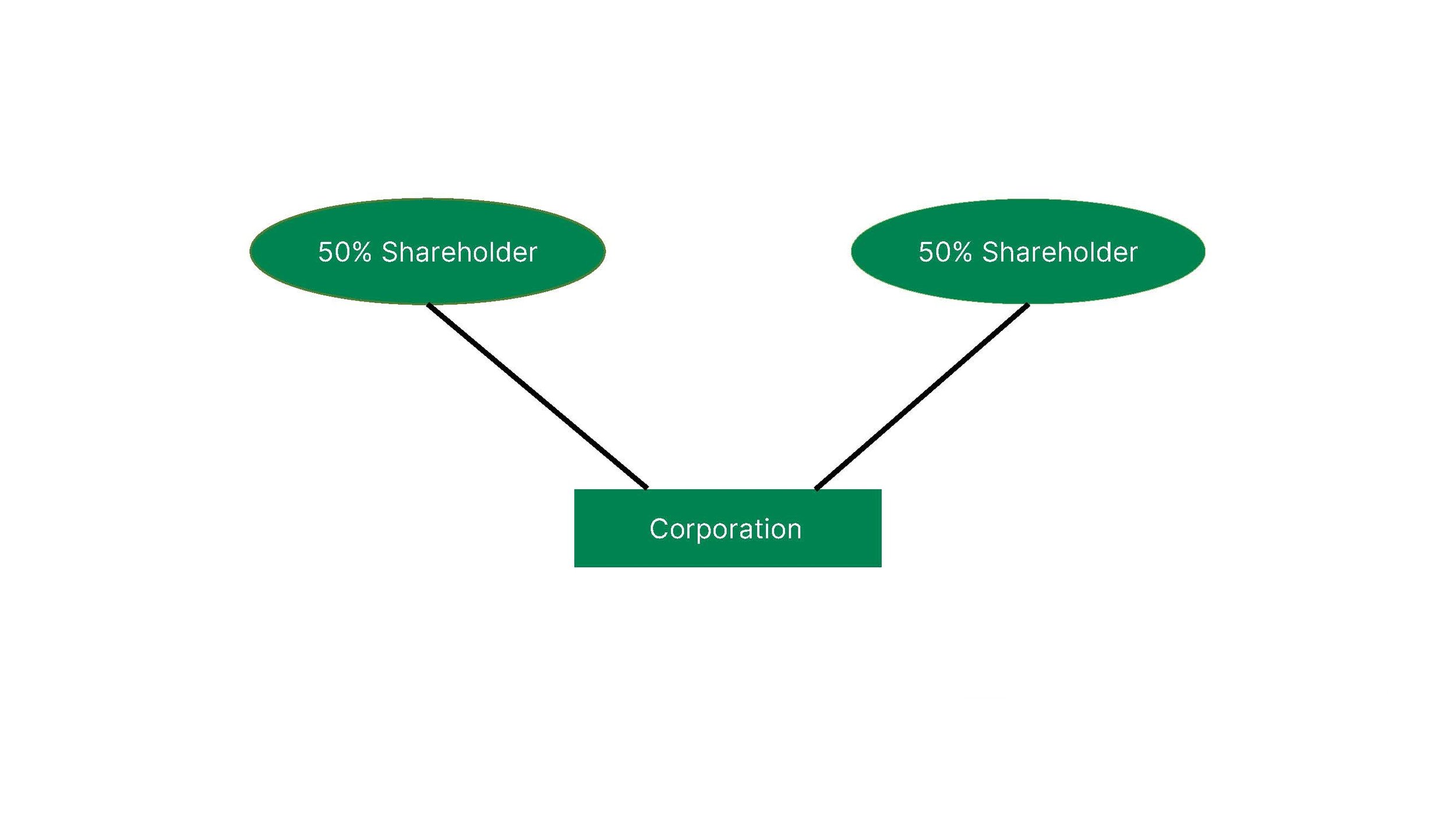

We see many cases on section 160. So we published this article with the Canadian Tax Foundation on whether two 50/50 shareholders are acting at arm’s length from their corporation when claiming a dividend.

Registration is Open for Tax Dispute Update 2022

Attend our free, one-hour webinar on November 1 to ensure your clients’ Input Tax Credits are accepted by CRA. Tax experts and generalists alike will derive critical information from this event, which was attended by over 350 professionals last year.

Community News - Charity Game 2022 was an Instant Classic!

Accountants from 17 firms played softball for charity on August 18, raising $11,000 for Girls on the Run Ottawa and The Dementia Society of Ottawa and Renfrew County. Click here to see photos.

Ottawa Business Journal Reports on Blachford Tax Law Charity Game 2022

The Blachford Tax Law Charity Game 2022 came down to the wire. We had a wonderful day and raised $11,000 for this year’s charities, Girls on the Run Ottawa and The Dementia Society of Ottawa and Renfrew County.

The Blachford Brief – Summer 2022

Welcome to the Spring edition of The Blachford Brief. Each quarter we provide content to help your clients avoid tax disputes and catch you up on news from our professional community.

Dean Publishes Article on ITC Eligibility

Many businesses rely on ITCs for their financial survival, but don’t know what’s required to claim them. Some auditors don’t know either. So Dean co-authored an article on ITC eligibility for the CTF’s Tax for the Owner-Manager journal.

Dean on The Tax Chick Podcast

Amanda Doucette is a tax lawyer in Saskatchewan who produces high-value content for business owners. It was a blast to be on her podcast to talk about common audit flags and how to prepare in advance.

Community News - 10 Local Events to Check Out this Summer

This past quarter has been a grind for accountants. To help you shift gears and plan something fun for you and your family this summer, here are 10 local events to check out.

The Blachford Brief – Spring 2022

Welcome to the Spring edition of The Blachford Brief. Each quarter we provide content to help your clients avoid tax disputes and catch you up on news from our professional community.

Dean Quoted on Bloomberg in Loblaw Article

This quarter the Supreme Court decided against CRA in Canada v. Loblaw Financial Holdings Inc. Read Bloomberg’s article by James Munson, which quotes Dean Blachford and explains the wide-reaching impacts of the case.

Register for CPA Ottawa’s Tax Update 2022

This 1.5hr, virtual event on March 10 will feature Jamie Golombek, Caitlin Butler, and Jennifer Dawe, plus bonus greetings from Justice Gabrielle St-Hilaire of the Tax Court of Canada. Register to get the most current expert advice ahead of tax season.

Community News - Life Lessons from Successful Retired Accountants

Learn the secrets to a successful, rewarding accounting career, and what mistakes to avoid, from Garth Steele of Welch, Hugh Faloon of GGFL and Susan Holtom of Bouris Wilson.

The Blachford Brief – Winter 2021

Welcome to the Winter edition of The Blachford Brief. Each quarter we provide content to assist you in helping your clients avoid tax disputes and catch you up on news from our professional community.

Dean Published on CanadianContractor.ca

Construction businesses have ridden a roller coaster during the COVID-19 pandemic. The last thing they need now is a tax dispute. That’s why Dean wrote “Protecting Yourself from Tax Liability” for CanadianContractor.ca.